The journey to securing your first investor check is often punctuated with rejection. Convincing someone to believe in your vision enough to invest in it, especially when all you have is an idea and a dream, is no small feat. The reasons are manifold: your pitch might not hit the mark initially, your product could still be in its embryonic stage, and the daunting reality that investors are typically hesitant to be the first to commit funds. This blog post illuminates the intricacies of securing that crucial first investment, offering strategies that have the potential to turn a daunting task into an achievable goal.

The Importance of a Pitch Deck

For many founders, the initial attempt at creating a pitch deck can be a humbling experience. The first version may fall short of expectations, potentially lacking the clarity and impact needed to capture an investor's attention. In some cases, these early iterations could be considered subpar or, frankly, just outright suck. This is not only common but part of the iterative process of refining your pitch.

The challenge lies not just in the content but in the presentation. A pitch deck is not an exhaustive business plan but rather a concise, persuasive tool designed for impact rather than detail. It should highlight your startup's potential without overwhelming the viewer with excessive information. This balance is critical and often difficult to achieve on the first try.

Fortunately, founders are not without resources. Examples like Sequoia Capital's renowned pitch deck template provide a solid foundation on which to build, offering structure and key elements that should be included. Additionally, platforms such as PitchDeckHunt.com offer insights into successful pitch decks from companies that have managed to secure funding. These resources are invaluable for understanding what works, what doesn't, and how to convey your startup's story compellingly.

The journey from a lackluster first attempt to a polished, effective pitch deck is a path most founders will traverse. It's a process that requires patience, persistence, and a willingness to learn from each iteration. With each revision, the pitch deck becomes not just a presentation but a reflection of the startup's evolving narrative, sharpened by feedback and clarified by focus. In embracing this process, founders can transform their initial, perhaps inadequate, attempts into powerful tools that captivate and convince investors of their startup's potential.

Demonstrating Tangible Progress

Investors are fundamentally interested in a founder's ability to execute their vision rather than the allure of a concept alone. Demonstrating that you have moved beyond the ideation phase to create a tangible product or prototype is a critical milestone in convincing investors of your startup's potential. This tangible proof serves as a testament to your commitment to solving a real problem and your capability to navigate the complexities of turning an idea into reality. It's not merely about showcasing what you intend to do but providing concrete evidence of what you've already accomplished. The presence of a product or prototype signals to investors that you are serious about your business and have taken the first crucial steps towards market validation.

Leveraging resources like Fiverr or Upwork to develop this proof of concept can be an incredibly strategic move, especially for founders operating within tight budget constraints. These platforms offer access to a wide range of talents, from software development to design, allowing you to create a prototype that effectively communicates your vision. This approach not only demonstrates your resourcefulness but also your ability to lead and manage a project to fruition, even with limited resources. By presenting a working model or even detailed mockups of your product, you significantly bolster your pitch, illustrating not just what could be, but what is. In doing so, you elevate your discussions with investors from speculative brainstorming to a serious dialogue about scaling and growth, positioning your startup as a viable candidate for investment.

Friends, Family, and Fools

Securing the initial investment for a startup often presents a formidable challenge for founders, primarily due to the inherent reluctance among professional investors to be the first to contribute capital. This hesitation is rooted in a fundamental concern: the risk of being the lone investor in a venture that fails to attract further funding. In the startup world, there's a prevailing preference among investors to board a train already in motion rather than to be the pioneer passenger on a stationary one. This dynamic underscores the critical importance of the first investment, often making it the hardest check to secure. It's not just about finding someone who believes in your vision; it's about finding someone willing to take the leap of faith that will inspire others to follow.

In this context, the role of the so-called three F's—friends, family, and, somewhat humorously, fools—becomes crucial. These early backers, though they might contribute relatively modest amounts, provide much more than just financial support. Their willingness to invest acts as a crucial validation of both the founder's credibility and the potential of the startup itself. It signals to the broader investment community that there are individuals who believe in the founder’s vision and potential enough to risk their own money. This initial vote of confidence can be instrumental in breaking the inertia and catalyzing further investment from more traditional sources.

It is essential, however, that founders approach this initial fundraising with transparency and integrity. While friends and family may be more inclined to invest based on personal relationships rather than cold, hard business calculations, they deserve a clear understanding of the high-risk nature of startup investments. Founders should ensure that these early supporters are fully informed of the speculative nature of their investment, highlighting the potential for both significant returns and total loss. This honest dialogue not only maintains trust but also prepares the initial investors for the startup's unpredictable journey ahead. Through this foundational support, startups can gain the momentum needed to attract further investment, transforming the daunting task of securing the first check into the first step towards broader financial backing.

Bootstrapping and Sweat Equity

For founders without access to a financially supportive network, bootstrapping and offering equity to incentivize early team members become viable strategies. Progress, no matter how incremental, is key. It demonstrates determination and can eventually attract professional investors.

Conclusion

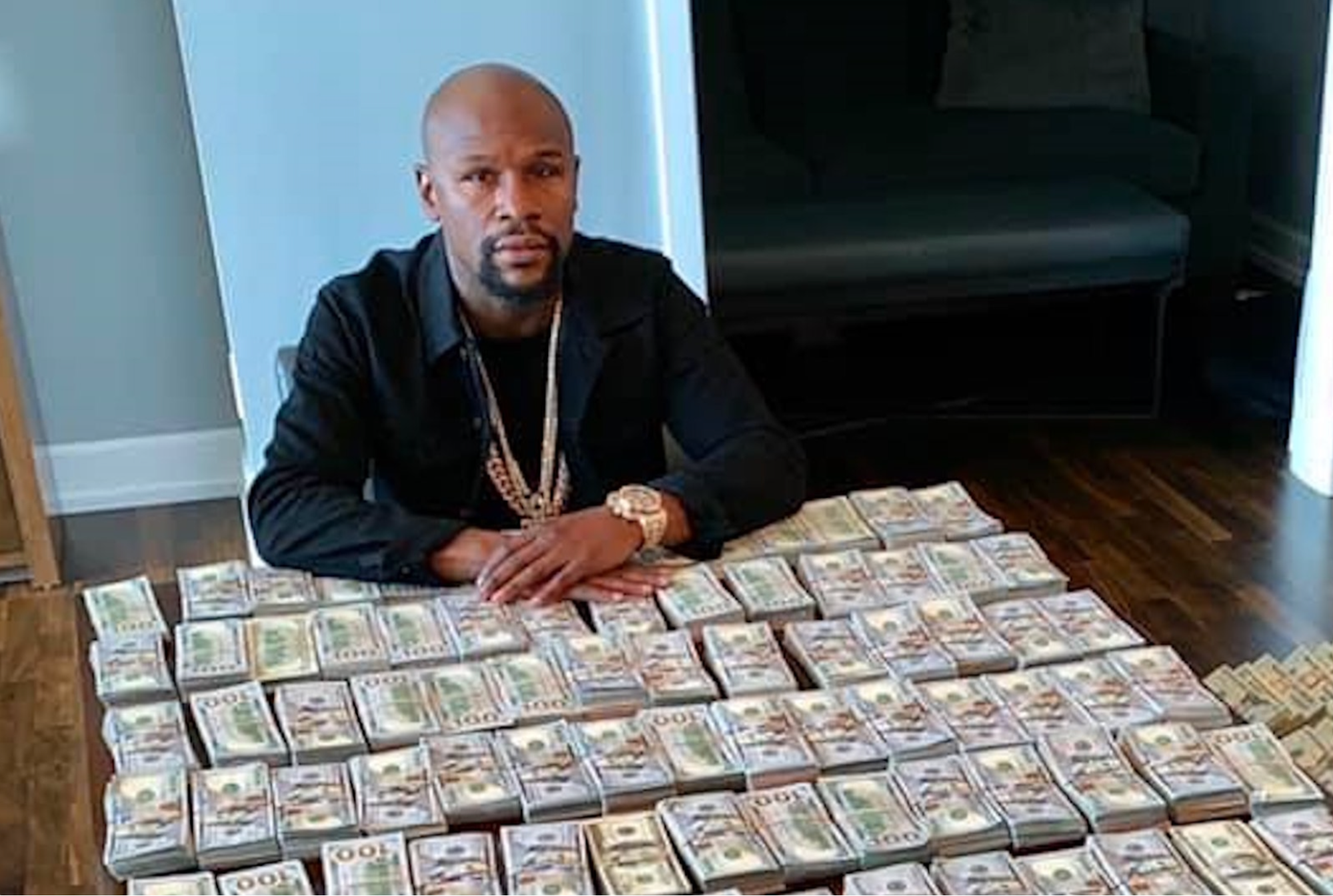

The first check is often described as the hardest to secure, not because of a lack of innovative ideas, but due to the inherent risks involved in early-stage investing. However, with a well-crafted pitch, proof of concept, and strategic networking, bridging the gap between vision and investment becomes a tangible reality. "Stacking dimes" may be a slow process, but it's one that builds a firm foundation for your startup's future growth.

Securing the first investment check is a pivotal moment in a founder's journey, setting the stage for all future fundraising endeavors. It's a testament to a founder's perseverance, the viability of their idea, and their potential to execute on a grand vision. Remember, every "no" brings you one step closer to that game-changing "yes." As you embark on this endeavor, let this guide serve as a beacon, illuminating the path towards securing that elusive first investment.

For more insights into navigating the startup ecosystem and to access a wealth of FREE RESOURCES tailored specifically for founders, SUBSCRIBE to our community. Follow us on TIKTOK for more tips and tools on making your startup journey a success.